|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

What Mortgage Can I Afford: Understanding Your Options and LimitsEmbarking on the journey to homeownership can be both exciting and daunting. One of the most critical questions you'll face is, 'What mortgage can I afford?' Understanding your financial capabilities and the various factors that influence your mortgage affordability is key to making a smart investment. Factors Influencing Mortgage AffordabilityIncome and Employment StabilityYour income is the primary factor that lenders consider when determining your mortgage affordability. A stable job with a steady income stream provides lenders with confidence in your ability to make consistent payments. Credit ScoreYour credit score significantly impacts the mortgage interest rates you're offered. A higher score can lead to more favorable terms, making your mortgage more affordable in the long run. Debt-to-Income Ratio (DTI)DTI is a critical metric used by lenders to assess your financial health. A lower DTI indicates that you have a good balance between debt and income, which can increase your borrowing potential. Calculating Your Affordable Mortgage AmountTo determine what mortgage you can afford, consider using the following formula:

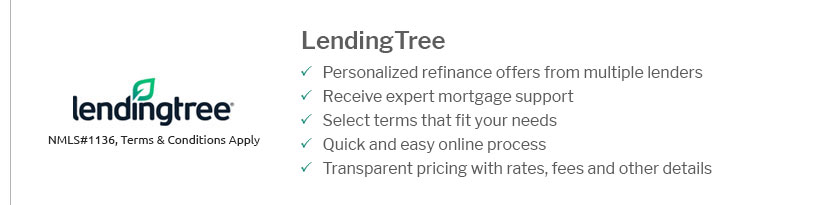

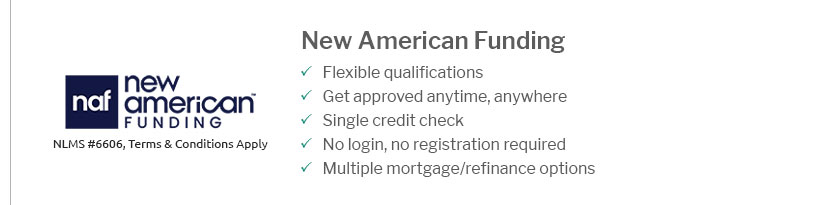

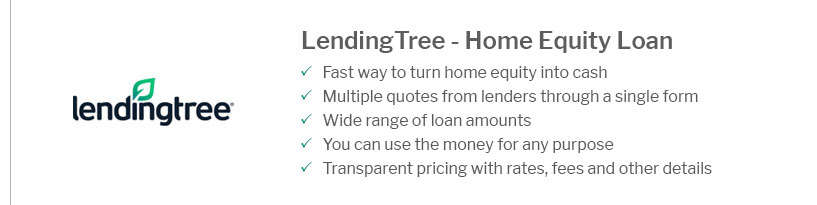

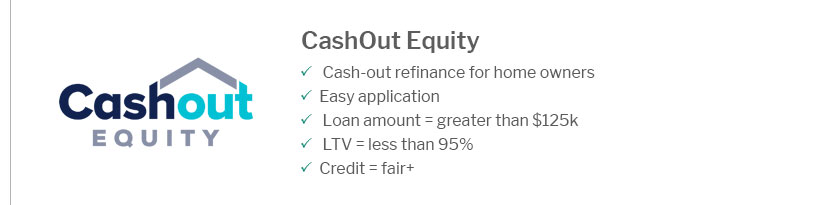

With these figures, you can use online calculators or consult home mortgage loan companies to get an estimate of your affordable mortgage. Maximizing Your Mortgage AffordabilityImproving Your Credit ScorePaying down existing debts and ensuring timely payments can boost your credit score, improving your loan terms. Saving for a Larger Down PaymentA larger down payment reduces the mortgage amount you need, which can lower your monthly payments and interest costs. Exploring Loan OptionsDifferent loan types have varying terms and conditions. For example, a home equity loan in Rhode Island might offer better rates for your situation. FAQs: What Mortgage Can I Afford?

https://www.wellsfargo.com/mortgage/home-affordability-calculator/

Find out how much house you may be able to afford with our mortgage affordability calculator. See annual property taxes, homeowners insurance, and mortgage ... https://www.nerdwallet.com/calculator/how-much-house-can-i-afford

This states that you shouldn't spend more than 28% of your gross (or pre-tax) monthly income on home-related costs, and no more than 36% on ... https://www.zillow.com/mortgage-calculator/house-affordability/

Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and ...

|

|---|